Welcome to the crypto site. My name is Victor, and today: TradingView indicators. Join the discussion on the CryptoViktor

TradingView indicators

today we are going to take a look at TradingView’s technical analysis and indicators. These tools help us analyse the cryptocurrency market and make informed decisions about investments. I would like to remind you that this is not a financial recommendation, but my personal opinions and analysis.

The TradingView service is one of the best for analysing charts and conducting research. It provides an opportunity to use many indicators that help traders and investors understand the current state of the market. Today I will share my experience of using some of these indicators.

How to use indicators

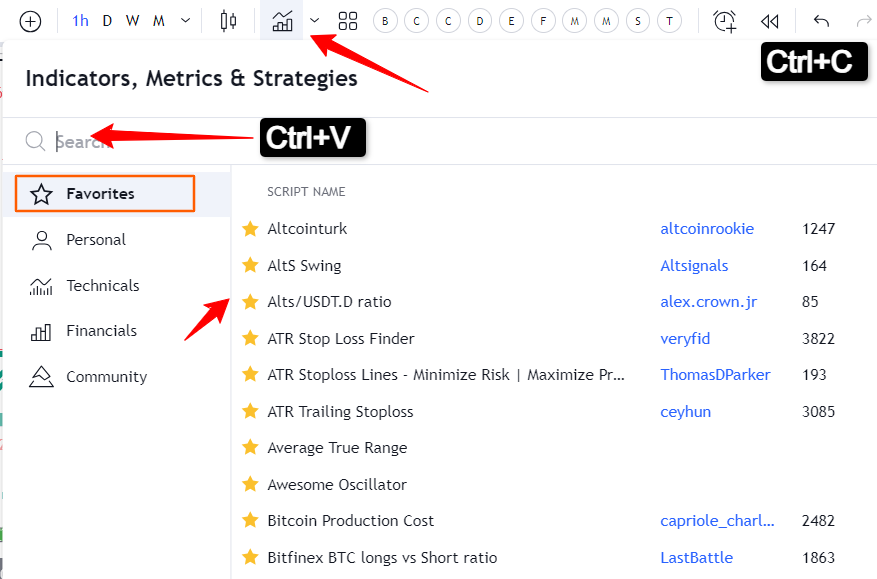

On the CryptoViktor website, you can find a list of indicators that I use. For example, you can copy the name of the indicator, paste it into the TradingView search, and add the indicator to your chart. This allows you to quickly and easily use the same tools I show in my videos.

Indicators help you identify trend direction, overbought and underbought zones, and possible entry and exit points. For example, the ATR (Average True Range) indicator helps to set stop losses by showing possible zones of fluctuations.

Examples of indicators

One of the most popular indicators is the CCI (Commodity Channel Index), which shows overbought and underbought zones. Another important indicator is the EMA (Exponential Moving Average), which displays average prices over a certain period and helps to determine the general direction of the trend.

For a more detailed analysis, you can use Fibonacci indicators. They help to identify key support and resistance levels that are important for making decisions about buying or selling assets.

Financial instruments

The CryptoViktor website also provides information on various financial instruments such as wallets and exchanges. These tools help you store your assets safely and conduct transactions on the market.

Some of the useful indicators for trading include oscillators such as the Stochastic RSI, which helps to identify possible market reversal points. Another important indicator is the MACD (Moving Average Convergence Divergence), which shows the relative strength of a trend and possible changes in direction.

Practical examples

Let’s take a look at some practical examples of using indicators on an altcoin chart. For example, the ATR indicator helps to determine the optimal points for setting stop losses, which is especially useful for traders.

The Fibonacci indicator shows in which zones it is best to buy or sell. For example, when the rate is in the red zone, it can be a signal to buy, and when it is in the green zone, it can be a signal to sell.

How to choose indicators

It is important not to overload your chart with a large number of indicators. It is enough to use two or three main indicators to get the most important information. This will help you avoid confusion and make more informed decisions.

You can always return to the initial settings by deleting unnecessary indicators or adding new ones. For example, the EMA indicator can be set for different periods to see the average direction over 20, 50, 100, or 200 days.

Tips for using indicators

Remember that each indicator was created by an expert and has its own unique properties. Use them to confirm your decisions and always consider the overall market context. For example, the CCI indicator helps to identify overbought and underbought zones, which can be useful for determining the best entry and exit points.

Another useful indicator is the Stochastic RSI, which helps to identify possible trend reversal points. Using these tools, you can better understand the market and make more informed investment decisions.

TradingView

The use of TradingView indicators is an important element of technical analysis and helps traders and investors make informed decisions. On the CryptoViktor website, you will find a lot of useful information about indicators and other financial instruments.

Remember that successful trading and investing require knowledge and experience. Use indicators to confirm your decisions and always follow the news and trends in the market. I wish you success in crypto trading and investing!

If you found this video useful, please like it, subscribe to the CryptoViktor channel, and share it with your friends. Write your comments and share your experience of using indicators. Let’s raise Ukrainian-language content in the rankings together and support the development of the crypto community!

*** Translated with www.DeepL.com/Translator (free version) ***