Welcome to the crypto site. My name is Victor, here is my YouTube video and description on the topic: Chainlink altcoin exchange rate forecast for December 2023 #LINK-USDT, using the TradingView service. Read and write comments to this publication.

Chainlink altcoin

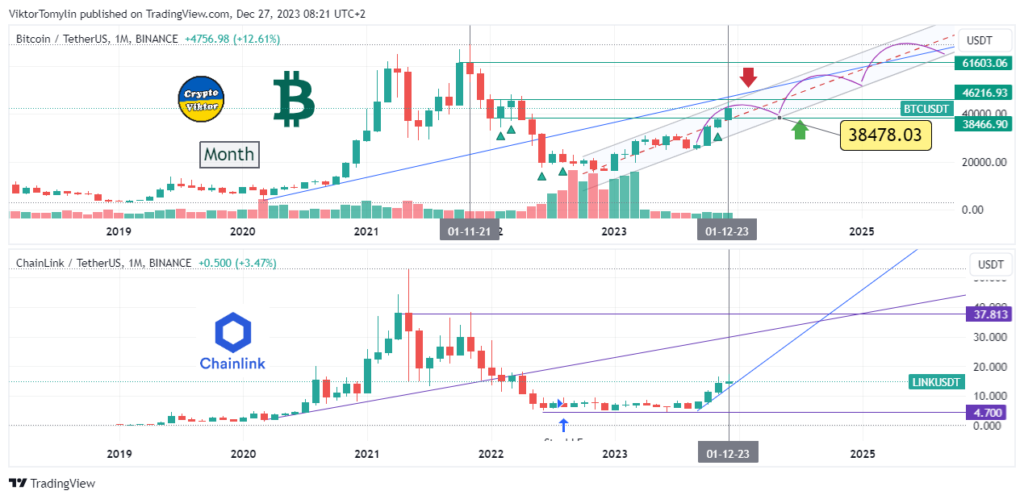

Monthly timeframe

Hello, my name is Victor. Today, on the 27th of December 2023, we’ll be taking a look at Chainlink (LINK). On the monthly timeframe, Chainlink is the 14th largest cryptocurrency by capitalisation and shows stability. This cryptocurrency has a market capitalisation of $9 billion and an active community that is engaged in the development of the latest technologies, including Web3. I see potential for growth, but also possible consolidation by the summer of 2024.

Weekly timeframe

On the weekly chart, Chainlink is also in a consolidation phase. Indicators such as the stochastic oscillator and CCI show a downward trend, which may indicate a potential decline or continuation of the flat situation.

Daily timeframe

On the daily chart, Chainlink shows signs of a decline. The stochastic oscillator indicator indicates an overbought condition, which may indicate a need for accumulation before growth. The CCI indicator is in the middle zone, which may indicate potential growth after the accumulation phase.

Buyer/seller sentiment

There is uncertainty in the Chainlink market. The moving averages are set to sell, but the oscillators are in a neutral position, which could mean a potential market reversal.

Bitcoin outlook

Bitcoin is currently in an accumulation phase, and I predict that this phase may last for some time. This may affect Chainlink’s rate, as there is a correlation between these cryptocurrencies.

Summary of the course forecast for the month

In summary, I believe that Chainlink could go through a period of consolidation in the coming months. However, a return to previous highs is possible in 2024, especially if there is a correlation with Bitcoin.

[…] I usually apply the Fibonacci indicator to the charts of altcoins like Cardano to identify potential entry or exit points. This allows you to effectively respond to market changes and avoid significant losses that may occur due to sudden fluctuations in the exchange rate. […]