Welcome to the crypto site – category/altcoin. My name is Victor, and today: DOGE (Dogecoin) rate forecast for February 2024. Join the discussion on the topic. Crypto portal kriptovalyuta.com.

DOGE (Dogecoin) rate forecast

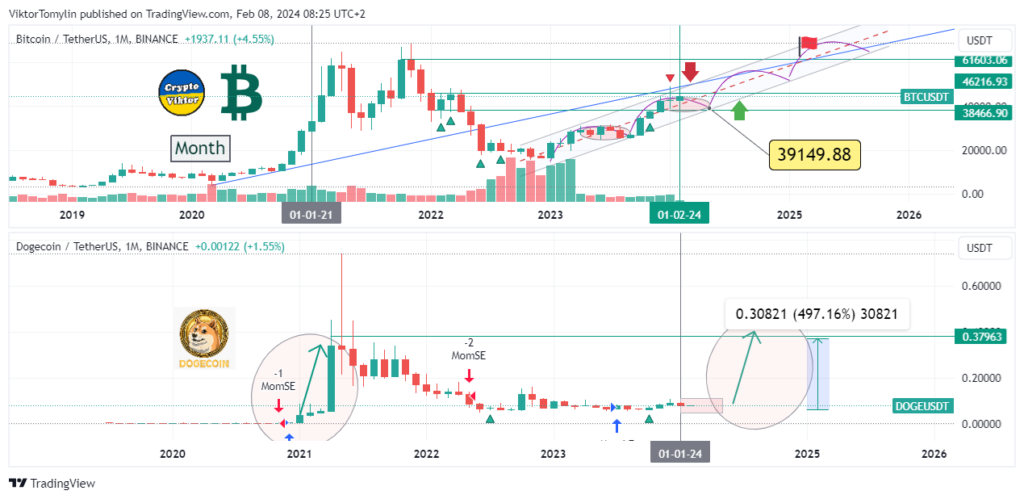

Monthly timeframe

Hello, I’m Victor from CryptoViktor UA. Today’s analysis focuses on Dogecoin (DOGE) for February 2024. Looking at the monthly timeframe, we can see that DOGE, after a significant rise in the past, is now going through a correction period. This decline may open the door for potential investors who prefer to enter the market at more attractive prices.

Weekly timeframe

On the weekly timeframe, Dogecoin is showing signs of volatility with a potential for short-term growth. It is important to keep an eye on key support and resistance levels to determine possible price movement scenarios. Despite the current uncertainty, there are positive signals that may point to a future recovery.

Daily timeframe

On the daily timeframe, DOGE continues to show mixed signals. However, community activity and interest in the cryptocurrency may contribute to its short-term growth. Traders should be prepared for possible fluctuations and use flexible strategies to maximise profits.

Buyer/seller sentiment

Sentiment on the Dogecoin market remains mixed. Some market participants are optimistic that the current correction is a good time to invest, while others are taking a wait-and-see attitude, analysing the overall market conditions.

Bitcoin, bitcoin

Bitcoin, as always, has a significant impact on the cryptocurrency market, including Dogecoin. The general trends of bitcoin and its current movements can provide valuable information about the potential development of the situation with DOGE.

Summary of the course forecast for the month

In summary, Dogecoin is in an important phase that could determine its future in the coming months. Given the current correction and the general market sentiment, there are chances for a recovery, but investors should proceed with caution given the possible volatility.