Welcome to the crypto site. My name is Victor, and today: Entry to the Crypto, buy Token, 22-04-24. Join the discussion on the topic – CryptoViktor.

Entry to the Crypto, buy Token

Hello everyone, my name is Victor! Today’s video is dedicated to analysing the cryptocurrency markets, and we will focus on identifying potential entry points for investing in various crypto projects.

Bitcoin analysis

Let’s start with Bitcoin, which has recently gone through a critical moment – halving. This process usually affects the price as the reward per block decreases, which could theoretically lead to a decrease in the supply of coins and an increase in the price. Now we can see that Bitcoin has broken out of the bottom of the tapering formation and started moving upwards, which may indicate the beginning of a new phase of growth. The CCI indicator is showing positive signals, which points to a potential strong price recovery.

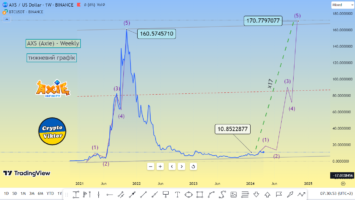

In the analysis of altcoins that I conducted in my last video, we take a closer look at several promising projects that may prove interesting for investment. Each of these projects is showing certain signals that may indicate potentially profitable entry points.

LINK (Chainlink)

Chainlink is known for its ability to provide reliable oracle services for blockchain ecosystems. On the trading platform, we can see that LINK has broken out of a narrowed range and is showing signals for possible upside. This makes LINK attractive for short- and long-term investment as its technology continues to attract new integrations.

FLOKI.

This is one of the lesser-known projects that nevertheless shows significant upside potential. FLOKI has recently shown signals of breaking out of consolidation, which may indicate the beginning of a new rally. This is a good reason to take a closer look at the project, especially if you are looking for high-risk but potentially high-yield opportunities.

General strategies for investing in altcoins

When analysing altcoins, it is important to take into account not only current trading performance but also the overall investment strategy. The cryptocurrency market is very volatile, and every investor should have a clear understanding of their investment goals and risks. My approach is to combine technical analysis with fundamental project evaluation, which allows me to balance my portfolio and reduce potential risks.

It is important to remember that every investment should be well thought out. Always do your own research and do not rely solely on external signals. Subscribe to my channel where I will continue to share my analytical reviews and opinions on the cryptocurrency market!

–