Greetings to you on the crypto site. My name is Viktor and today I will share my opinion about #bitcoin, #btc-usdt, using the TradingView service, here Bitcoin Forecast for the Week of 11-11-2024

Bitcoin Forecast

November 11, 2024 Crypto Market Review: Bitcoin, Altcoins, Liquidations, and Overall Forecast

Congratulations, friends! I wish you successful crypto investing. Today, November 11, 2024, in our review, we will consider the current situation on the cryptocurrency market. We’ll focus on Bitcoin technical indicators, including the fear and greed index, liquidation charts, and talk about the outlook for altcoins.

Fear and Greed Index: What to Expect Next?

Today, the Fear and Greed Index has reached 78 points, indicating growing greed among investors who are actively buying Bitcoin. Buyers are twice as active as sellers. This confirms that the market expects further growth, but it is important to consider the risks for those entering the market at the current stage.

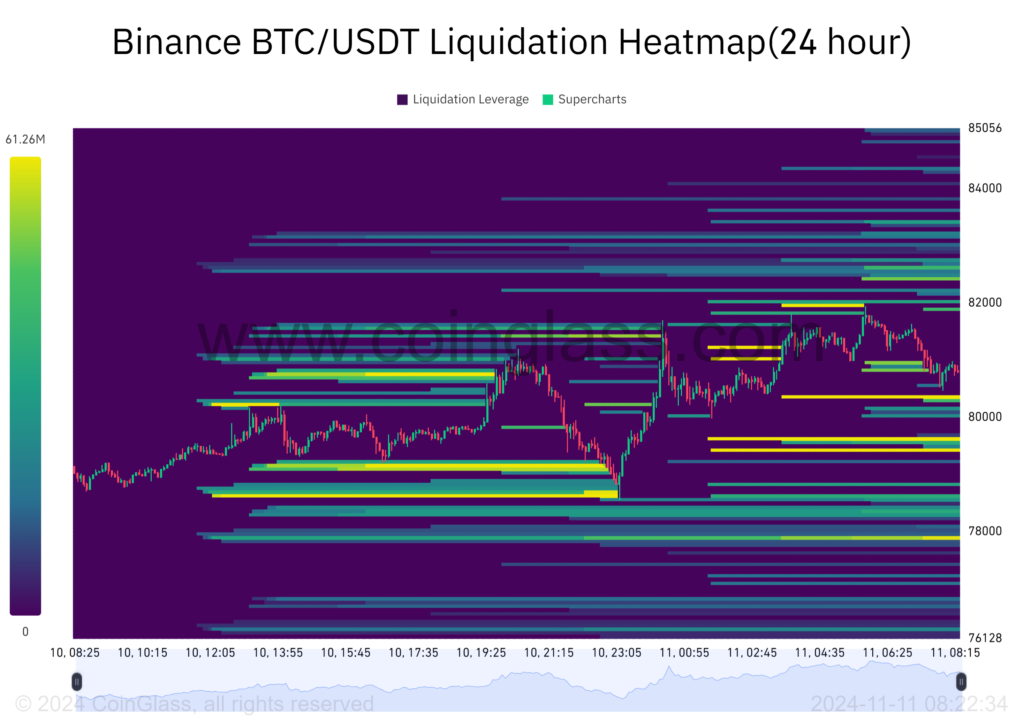

Liquidation Heatmaps: Key Levels for Bitcoin

The liquidation maps show accumulation of activity at the levels of $80,000 and $79,000. It is likely that the rate will return to these levels to gather liquidity before continuing the move. The analysis shows that large traders focus on these levels, placing stops, which can play an important role in further price dynamics.

It’s also worth mentioning that the record buying volumes of Bitcoin through ETFs may limit the potential for big pullbacks. So, for those expecting a significant drop in bitcoin, the likelihood of a return to previous levels is becoming less and less likely.

Bitcoin Movement Forecast and Impact on Altcoins

Bitcoin is expected to move towards $85k in the short term where a period of consolidation may occur. This will allow altcoins to partially recover, especially if Bitcoin’s dominance begins to wane, which could create favorable conditions for altcoin growth.

At the same time, the overall dominance indicator shows that interest in altcoins is growing from minimal positions, and if the current trend continues, the alt season could become a reality for investors.

Gold expectations and their impact on cryptocurrencies

On the monthly chart of gold, there is a powerful red candle, which may indicate a decrease in interest in this asset. This facilitates the movement of capital into Bitcoin and other crypto-assets. If this momentum continues, cryptocurrencies, particularly Bitcoin, could see significant growth.

Conclusion: opportunities for investors and current risks

At the current stage, the market is showing positive signals for both Bitcoin and Altcoins. It is important to follow the main indicators and remain cautious due to the high level of greed, because excessive demand can lead to a quick correction. For daily updates and more detailed analytics, join our community on Discord!

- Дивитись відео: Біткоїн — Прогноз на Тиждень, 11-11-2024

Bitcoin ➤ 130К USDT (чашка з ручкою), #cryptoviktor (моє нове відео) ➤ https://youtu.be/NIAZgGWV3GI