Greetings to you on the crypto site. My name is Viktor and today I will share my opinion about #bitcoin, #btc-usdt, using the TradingView service, here Bitcoin Rate Forecast for the week of 08-10-2024.

Bitcoin Forecast for the Week

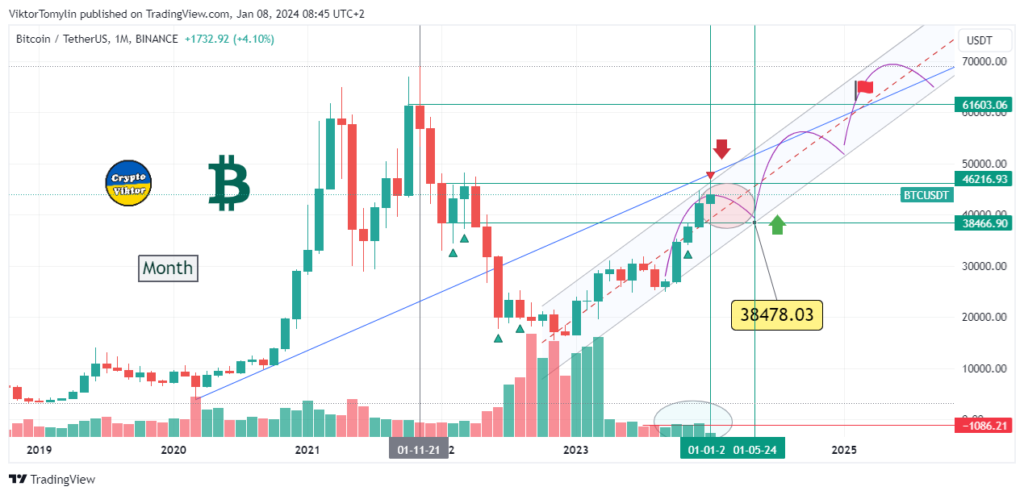

Monthly timeframe

Hello, my name is Victor. Today, 8 January 2024, I would like to share with you my analysis of Bitcoin for this week. On the monthly timeframe, I see that trading volumes remain very low, which may indicate a need for consolidation. This could be a signal for a potential drop in the rate in the near future.

Weekly timeframe

On the weekly chart, the stochastic oscillator indicator shows that the rate may leave the overbought zone and go down. This may indicate the beginning of a downward phase. I expect a correction, which may not be very deep, but it will still be noticeable.

Daily timeframe

On the daily chart, the divergence indicator shows that there may be a decline. This may indicate a need for accumulation before growth. I expect the market to consolidate, but the exact time of the start of this downward movement remains uncertain.

Buyer/seller sentiment

There is a split opinion on the bitcoin market. Although many predict continued growth, there are also short ideas that I hold. The market sentiment is split roughly in half.

Weekly exchange rate forecast summary

In summary, I believe that bitcoin could go through a period of consolidation in the coming months. However, a return to previous highs is possible in 2024, especially if there is a correlation with bitcoin.

OpenAI

The current technical analysis for Bitcoin (BTC) presents a mix of bullish and bearish sentiments:

- Some analysts are highly optimistic, predicting a long-term bullish trend for Bitcoin with a potential target of $180,000. They emphasize Bitcoin’s consistent growth over the years and suggest that, despite potential short-term fluctuations, the long-term trajectory is upward.

- Another perspective warns of a potential end to Bitcoin’s bull market, suggesting that it will not make a new all-time high in the foreseeable future. This analysis is based on a detailed study of market cycles and technical patterns.

- A more immediate analysis sees Bitcoin in a stable accumulation phase near $38,000, with expectations of a rise to $42,000 in the near future.

- Contrarily, another analysis suggests a bearish outlook in the short term, with potential targets as low as $24,000, indicating a correction after recent gains.

- Another viewpoint sees Bitcoin regaining support after a short-term decline, with an expected increase to around $39,000.

📈 Key support and resistance levels for Bitcoin:

- Support levels are around $35,560 to $36,000.

- Resistance levels are identified at approximately $38,000 to $39,000.

🎒 To capitalize on these market trends and explore advanced trading strategies, consider joining 3Commas, a leading AI trading platform.