Greetings to you on the crypto site. My name is Viktor and today I will share my opinion about #bitcoin, #btc-usdt, using the TradingView service, here Bitcoin Rate Forecast for the week of 15-10-2024.

Bitcoin Forecast for the Week

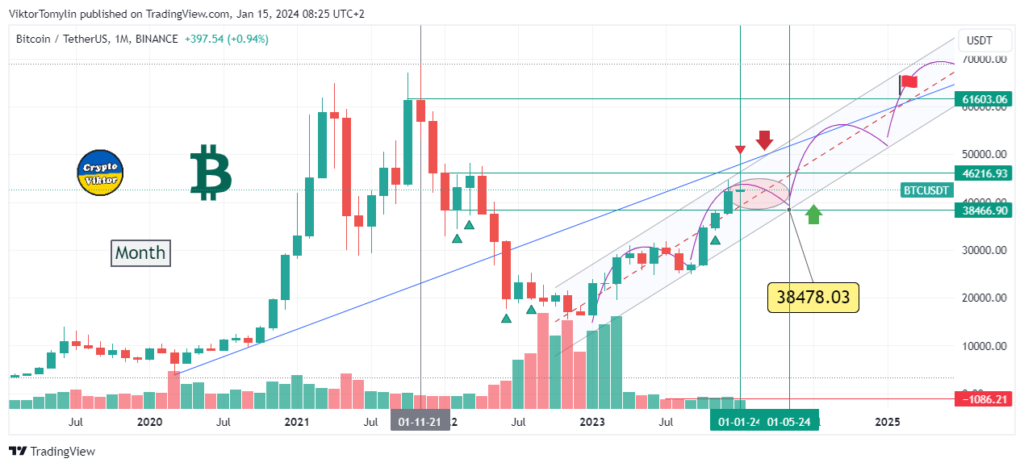

Monthly timeframe

Hello, my name is Victor, and today we’re going to take a look at the monthly timeframe of bitcoin. In my opinion, we are currently witnessing a trend reversal that will last for several months before the next halving. As for the decline, I think it will last until the halving point. Let me remind you that this is just my view of the market.

Weekly timeframe

On the weekly chart of bitcoin, we can see that it tried to reach the 47,000 level, but failed to hold the position and went down. This is a signal that the market is not ready for growth and we can expect further declines. The CCI indicator also indicates a move from the overbought zone to the underbought zone.

Daily timeframe

As for the daily timeframe, a slight decline is possible, as indicated by the Stochastic indicator. However, the overall picture remains negative, and technical indicators point to a decline. Bitcoin is currently in the process of selling off, and in general, indicators show a downward trend.

Buyer/seller sentiment

Analysing the sentiment of market participants, we can see that short positions prevail. This is also confirmed by my own analysis. More than 500 market participants share the opinion that the exchange rate will decline. This suggests that the dominant sentiment on the market is one of expectation of a decline.

Weekly exchange rate forecast summary

To summarise, in my opinion, this week we may see a slight increase within the current corridor, but the overall trend remains downwards. It’s important to remember that this is just my opinion, and I always advise you to do your own research before making investment decisions.

The current technical analysis for Bitcoin (BTC) presents a mix of bullish and bearish sentiments:

- Some analysts are highly optimistic, predicting a long-term bullish trend for Bitcoin with a potential target of $180,000. They emphasize Bitcoin’s consistent growth over the years and suggest that, despite potential short-term fluctuations, the long-term trajectory is upward.

- Another perspective warns of a potential end to Bitcoin’s bull market, suggesting that it will not make a new all-time high in the foreseeable future. This analysis is based on a detailed study of market cycles and technical

patterns

- A more immediate analysis sees Bitcoin in a stable accumulation phase near $38,000, with expectations of a rise to $42,000 in the near future.

- Contrarily, another analysis suggests a bearish outlook in the short term, with potential targets as low as $24,000, indicating a correction after recent gains.

- Another viewpoint sees Bitcoin regaining support after a short-term decline, with an expected increase to around $39,000.

📈 Key support and resistance levels for Bitcoin:

- Support levels are around $35,560

- Resistance levels are identified at approximately $38,000 to $39,000.

This post was not just informative but also very thought-provoking. Thanks for sharing your insights!