Greetings to you on the crypto site. My name is Viktor and today I will share my opinion about #bitcoin, #btc-usdt, using the TradingView service, here Bitcoin: Growth Week Ahead? Market Analysis 02.24.25 New week, new Bitcoin forecast from @CryptoViktor_UA! Will we see growth? Analyzing market factors, indicators, and investor sentiment. Important author’s thoughts in our fresh overview!

Bitcoin

Article Plan:

- Where to find the CryptoViktor UA community

- Liquidation Map Analysis: Short-term and Global

- Risk Indicator and Bitcoin Stock to Flow

- Impact of the “Red-Haired” US President’s Actions on Gold, S&P 500, European, and Bitcoin Markets

- Bitcoin and USDT Dominance: What the Charts Show

- Total Cryptocurrency Market Cap and Altcoin Situation

- Bitcoin Technical Analysis: Monthly, Daily, and Hourly Charts, MACD, RCI, Horizontal Volume Indicators

- Weekly Forecast and Key Takeaways

Article Sections:

Where to Find the @CryptoViktor_UA Community

Find the latest information and daily updates from @CryptoViktor_UA on the website: cryptoviktor.com/. For quick forecasts and polls, join the Telegram channel. For deeper communication – Discord. Don’t miss the daily Bitcoin video forecasts and text reviews on the website! Be aware of scammers, the real @CryptoViktor_UA never messages privately with offers!

Liquidation Map Analysis: Short-term and Global

Liquidation map analysis on the 12-hour timeframe shows balanced activity, with liquidity accumulating both above and below. A global view on the 3-day and weekly charts demonstrates a significant volume of liquidations last week, but new accumulation is already underway. The author suggests that “whales” may initially collect liquidity in the 94-93 zones, and then direct the price movement upwards. However, the cryptocurrency market is often manipulative, and the future is certainly unknown.

Risk Indicator and Bitcoin Stock to Flow

The risk indicator shows a “green zone” for many cryptocurrencies, including Bitcoin, Ethereum, Solana, ADA, DOT, and Doge, signaling a low level of risk for purchases. The Bitcoin Stock to Flow indicator is in the “orange zone,” indicating potential for further growth, compared to previous cycles. The author suggests that the current cycle may be similar to the cycle before last, with one pronounced phase of maximum growth.

Impact of the “Red-Haired” US President’s Actions on Gold, S&P 500, European, and Bitcoin Markets

Analysis of the beginning of the year and the actions of the new US president reveals interesting trends. Gold shows significant growth (+12% in two months), likely as investors react to US economic policy. The S&P 500, the US business index, shows a slowdown in growth (+1.4% in two months). The European index, on the contrary, shows growth on par with gold (+12%), which may indicate capital flow and a shift in economic centers of influence. Bitcoin, in turn, added only 2% over the same period, showing a slowdown against the backdrop of traditional markets.

Bitcoin and USDT Dominance: What the Charts Show

Bitcoin dominance continues to grow (+6% in two months), indicating a capital flow from altcoins to Bitcoin as a more stable asset. At the same time, USDT dominance is growing, which may indicate the withdrawal of funds from the crypto market in anticipation of uncertainty.

Total Cryptocurrency Market Cap and Altcoin Situation

The total cryptocurrency market capitalization shows a slight decrease (-2% in two months), reflecting a general outflow of capital from the market. Altcoins have been particularly affected (-18% in two months), making them “extreme” in the current market situation, which is increasingly correlated with stock markets. The CCI indicator for altcoins is in the lower zone, signaling a potential reversal in the future.

Bitcoin Technical Analysis: Monthly, Daily, and Hourly Charts, MACD, RCI, Horizontal Volume Indicators

- Monthly Chart: The RCI indicator on the monthly chart is approaching the overbought zone, but has not yet reached it. Analogy with the previous cycle hints at the potential for further Bitcoin growth to RCI levels of 87-90, before a reversal phase occurs.

- Daily Chart: The MACD indicator is issuing a growth signal, similar to the previous signal that worked out successfully. Analysis of horizontal volumes shows resistance zones at 101 and 104 thousand, breaking through which will open the way for further growth. Current trading volumes remain low, but their increase is expected during the week.

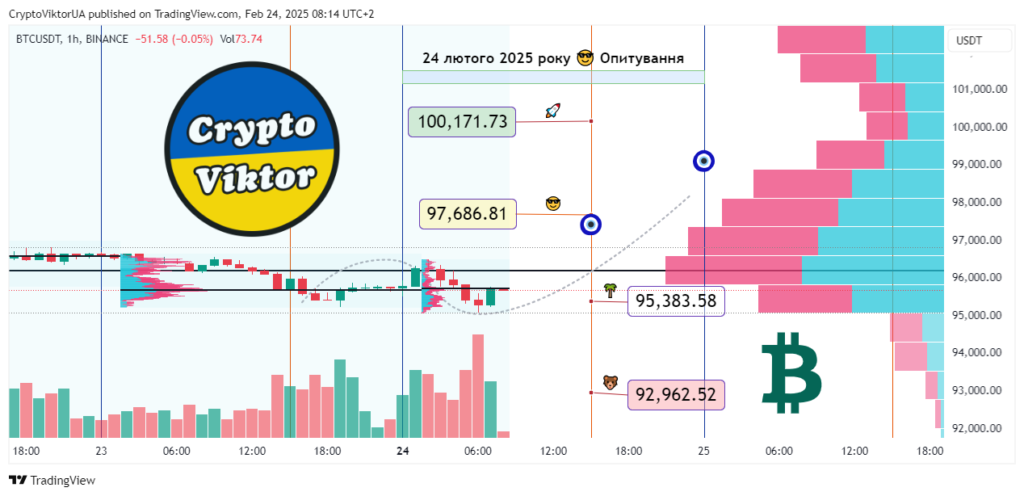

- Hourly Chart: Analysis of horizontal volumes on the hourly chart indicates activity zones in the 95-98 range. The European session yesterday lowered the price from the upper activity zone to the lower one. The author expects that the European session today will be the driving force for exiting the current zone and continuing growth to 97 and above.

Weekly Forecast and Key Takeaways

The general forecast from @CryptoViktor_UA for the week – a reversal and growth of the Bitcoin price is expected to begin. However, the author is adjusting their previous forecast for rapid spring growth, shifting expectations of peak prices to autumn 2025. Two scenarios are possible: rapid movement to maximum prices in spring (less likely) or a longer cycle peaking in autumn. The “cup and handle” pattern on the weekly chart has not fully played out, but the accumulation phase continues, and the potential for growth remains.

Summary:

The current situation in the cryptocurrency market remains uncertain, but technical indicators and analysis of trading volumes indicate the likelihood of the start of an upward Bitcoin movement this week. It is important to remember the risks and do your own research (DYOR). This is the author’s personal opinion, not financial advice. Follow daily video forecasts from @CryptoViktor_UA and participate in polls to stay informed about the crypto community sentiment!

- Прогноз Біткоїн на Тиждень, 24-02-2025 (моє відео українською в YouTube).

- 📌 Source: cryptoviktor.com/btc/