Greetings to you on the crypto site. My name is Viktor and today I will share my opinion about #bitcoin, #btc-usdt, using the TradingView service, here Prediction Bitcoin this week, 30-12-2024

Prediction Bitcoin

Bitcoin Weekly Highlights: Summary and Forecasts

Introduction

In this new review, I continue the combined analysis format that you liked. Together with the GPT chatbot, we analyze key events in the Bitcoin market, analyze analytical forecasts and discuss possible price movement scenarios. This week we will discuss liquidation levels, risk indices and possible future prospects.

Bitcoin Weekly News

Price Changes:

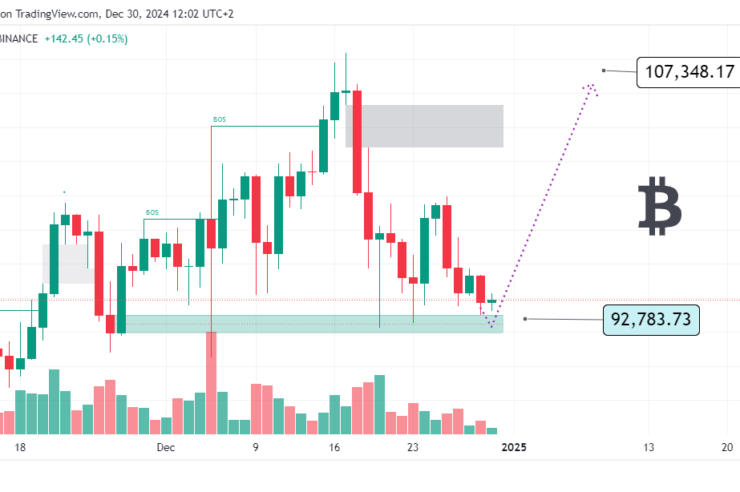

After reaching the $100,000 mark, the price of Bitcoin fell to $94,000, which is about a 10% decrease for the week.

Analysts predict further growth to $110,000 – $119,000 by the end of 2024 and to $135,000 – $140,000 by the end of 2029.

Market Capitalization Growth:

- In November 2024, the cryptocurrency market reached a capitalization of $347 billion, which is 3% more than the previous month.

Institutional Investor Interest: - Institutional investors continue to increase their activity, which creates favorable conditions for the development of the market.

Fear and Greed Index: - During the week, the index fluctuated between values of 67 and 73, which indicates an optimistic mood of investors.

Market Situation: Liquidation Levels and Forecasts

Liquidation Map:

- High liquidation activity is observed at the levels of $92,000 – $94,000. This indicates a possible downward price movement after breaking the support at $92,000.

Risk Index: - Bitcoin’s risk index is at 34, which indicates a moderate level of risk. The zone is considered favorable for long-term purchases.

Traders’ Positions: - 64% of traders on Binance are bullish, expecting a price increase in the short term.

Technical Analysis: Key Levels and Forecasts

Technical Indicator RSI:

- The daily chart shows the end of the correction phase. The RSI indicator has dropped to the level of 45, indicating a possible start of a new growth.

Support and Resistance: - The key support is at $92,000. If it is broken, this may lead to a further decrease.

The resistance level remains in the $100,000 – $105,000 zone.

Forecast: - In the short term, a movement within $92,000 – $94,000 is expected. A break of the upper limit may signal further growth.

General Conclusions

Despite the high market volatility, institutional interest and global macroeconomic factors support the positive mood of investors. Looking ahead, the start of the new year could be a pivotal moment for Bitcoin’s continued growth. Paying attention to key support and resistance levels will remain a key factor in making trading decisions.

- 📌 Source: cryptoviktor.com/btc/

- Дивитись відео: Біткоїн — Прогноз на Тиждень, 30-12-2024