Welcome to the crypto site. My name is Victor, and today: HFT (Hashflow) forecast for 2024 year. Join the discussion on the topic – CryptoViktor

HFT (Hashflow) forecast

Fundamental analysis and news of HFT (Hashflow)

Greetings! My name is Victor, and today I will share with you some fundamental analysis and news on the HFT (Hashflow) token. Hashflow is a decentralised cryptocurrency trading platform that offers innovative solutions for traders. The platform’s feature is the integration of social interaction and gamification elements, which makes the trading process more interesting and profitable.

Hashflow has positioned itself as one of the leading platforms for decentralised trading, ensuring transparency and efficiency of trading. The project’s official website provides all the necessary information about the platform, including its main functions and capabilities. With a capitalisation of more than $100 million, the project is ranked 410th among the best cryptocurrencies according to CoinMarketCap. An active community and constant updates make Hashflow a promising project in the cryptocurrency market.

Technical analytics of HFT (Hashflow)

Monthly Timeframe

On the monthly chart, we can see that the HFT rate experienced a significant increase in 2022, after which it quickly declined. Currently, the rate is hovering in the lower zone, which may indicate the possibility of growth if it returns to previous highs. However, this will require significant efforts from the community and market support.

Weekly timeframe

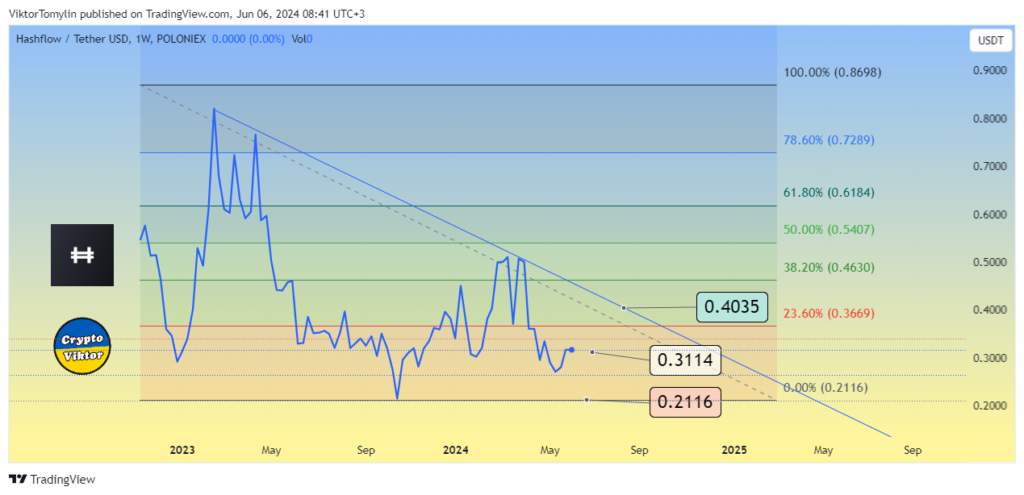

The weekly chart shows that the HFT rate is in the zone of maximum activity, at around $0.2-0.3. This support level is important, and if the rate can gain a foothold above it, we can expect further growth to the level of $0.4-0.5. It’s important to keep an eye on indicators and news that may affect the rate.

Daily Timeframe

On the daily chart, the HFT rate shows a downward trend with periodic recovery attempts. Indicators such as MACD and CCI point to the possibility of further declines before a new phase of growth. Now is not the best time to enter, but it is worth keeping an eye on the market and waiting for better investment opportunities.

Bitcoin forecast, BTC (Bitcoin)

As for bitcoin, the situation continues to be stable with the possibility of further growth. On the daily chart, the rate fluctuates between $65 and $71 thousand. If the rate manages to gain a foothold above $71,000, we could see further growth to new highs. Indicators show that bitcoin remains a strong cryptocurrency with great potential for growth.

On the weekly chart, we can see that bitcoin continues to move in a corridor between $65,000 and $71,000. This corridor is important for determining the further course of the rate. If bitcoin can overcome the $71,000 level, it will create favourable conditions for further growth to new highs.

Hashflow (HFT)

Hashflow (HFT) is a promising project with innovative solutions for decentralised cryptocurrency trading. Fundamental analysis shows that the project has an active community and stable development. However, technical analytics indicate the possibility of a further decline before a new growth phase. Investors should pay attention to key support and resistance levels, use buy strategies on pullbacks, and wait for favourable entry conditions.

As for bitcoin, the current situation looks stable with room for further growth. If the rate can overcome the $71,000 level, we can expect new highs. Thank you for your attention! If you enjoyed this video, please like, share with your friends, and subscribe to my CryptoViktor channel for the latest cryptocurrency forecasts and analysis in Ukrainian. Write your thoughts in the comments section to help other viewers make informed investment decisions. See you soon!

*** Translated with www.DeepL.com/Translator (free version) ***