Greetings to you on the crypto site. My name is Viktor and today I will share my opinion about #bitcoin, #btc-usdt, using the TradingView service, here Bitcoin Rate Forecast for the week of 19-02-2024.

Bitcoin Forecast for the Week

Bitcoin rate forecast for the week from CryptoViktor UA

Hello, my name is Victor and I’m happy to welcome you to the Bitcoin Weekly Forecast blog. Today we will dive into the analysis and forecast of the Bitcoin (BTC) exchange rate based on the latest market indicators. My goal is to help you understand current trends and future opportunities for successful investments.

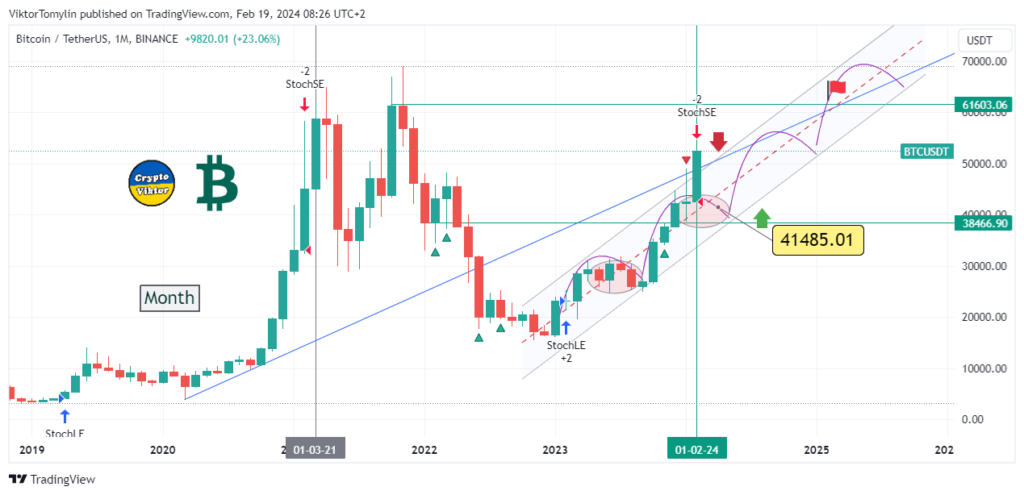

Monthly timeframe

On the monthly timeframe, we are seeing a consolidation of the BTC rate. This is not a direct prediction, but an analysis of past phases shows that after a period of growth and decline in 2023, we may be in for further consolidation. I expect this candle to decline slightly and return to around $48,000, bouncing off the trend line. In the spring, more attractive prices may appear for investors.

Weekly timeframe

On the weekly chart, we see a similar situation to previous cycles, when the rate moved from an overbought zone to an underbought zone. This could indicate a further decline in the rate. If the situation repeats itself, we can expect a reversal this week and then a decline.

Daily timeframe

The daily chart also shows that bitcoin is in need of correction. Indicators point to a move from the overbought zone to the underbought zone, which may indicate a future decline. I’ve been expecting this decline for several weeks now, and in my opinion, this week will be a transitional one with further declines.

Buyer/seller sentiment

Analysing market sentiment, most analysts and traders expect bitcoin to decline. This is supported by ideas about a possible decline of 17% or even 36%, which coincides with my analysis. Such expectations point to the prevalence of short positions among traders.

Weekly exchange rate forecast summary

To summarise, this week we can expect bitcoin to decline, taking into account the analysis of the monthly, weekly, and daily timeframes, as well as market sentiment. This could be a good opportunity for traders to consider short positions and investors to prepare for possible attractive entry points in the near future.

The forecast for Bitcoin (BTC) for the upcoming week indicates a mix of bullish and bearish sentiments across different analyses. According to CoinCodex, Bitcoin’s price is expected to see some fluctuations, starting at $52,732 on February 20, 2024, and potentially decreasing by -8.26% to $47,898 by February 26, 2024. This forecast suggests a short-term downward trend for Bitcoin’s price over the next week.

BeInCrypto’s analysis, on the other hand, provides a more general outlook without specific short-term predictions. The analysis highlights the importance of technical indicators such as the RSI, Moving Averages, and the MACD, suggesting that Bitcoin currently shows bullish momentum on a longer timeframe. The RSI above the 50 mark indicates that the market sentiment is bullish, and the crossing of the 50-day MA above the 200-day MA supports this positive trend.

It’s important to note that cryptocurrency markets are highly volatile, and predictions can change quickly based on global economic events, regulatory news, and changes in market sentiment. While technical analysis provides insights into potential price movements, it’s crucial for investors to conduct their own research and consider a wide range of factors before making investment decisions.

Remember, investing in cryptocurrencies carries risk, and it’s possible to lose some or all of your investment. Always ensure that your investment decisions align with your risk tolerance and financial goals.